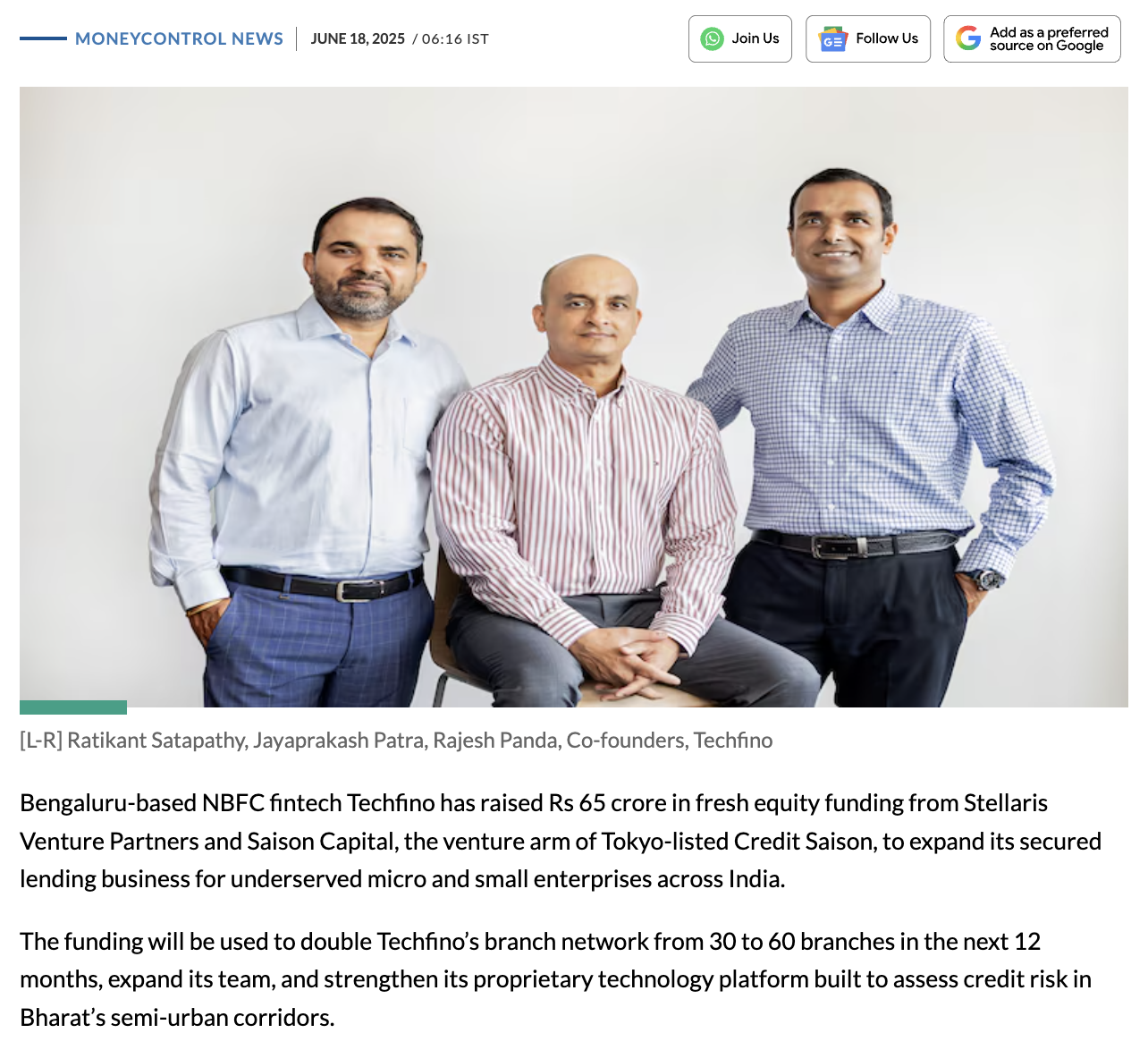

Fulfilling aspirations of the Underserved MSMEs

Designed to support and grow your enterprise. Our phygital application process ensures fast approvals and quick disbursements, allowing you to focus on your business without financial worries.

Empowering Growth, Transforming Future

At Techfino Capital, we are committed to fueling the growth of India's Micro and Small Enterprises businesses with our innovative financial solutions. As a leading Non-Banking Financial Company (NBFC), we specialize in providing fast, reliable, and tailored loans across the MSME and Education sectors.

Tailored financial solutions

across two key segments:

Our Lenders

You can contact

us for any question

You can contact us for any questions regarding our services. Whether you need information about loan options, tenure, or the application process, our team is here to assist you.

+

Years of Experience

+

Happy Clients

We provide secured loans to micro, small and medium businesses. We facilitate all your needs like business expansion, working capital needs and construction of building for business purposes.

We provide loans to shop owners, wholesalers, dairy business owners, small & micro manufacturing enterprises and professionals.

Loan amount eligibility is usually calculated basis the repayment capacity of the borrower and the value of the collateral. Repayment capacity can be ascertained based on factors such as income, age, qualifications, credit score, etc.

You can apply for a loan through any of the following ways:

You can apply directly through our website by clicking on Apply Now or contact our Sales team at +91-8069474744

In terms of para 5.9.5 of RBI/2017-18/87DNBR.PD.CC.No.090/03.10.001/2017-18(Directions on Managing Risks and Code of Conduct in Outsourcing of Financial Services by NBFCs) , issued on November 09, 2017, we hereby notify all those whom it may so concern, that the company has terminated the services of Ms. Ninjacart Services Private Limited on and with effect from 20th October, 2024 and that on from that date Ms Ninjacart Services Private Limited would no longer be a service provider to the Company and the public at large is notified not to engage with them in such capacity.

Customer Testomonials

Articles

Our Presence is Expanding, We Are Growing Nationwide

+

Branches

+

Team member

+

Happy Customers

.png)